CRYPTOCURRENCY 101

CRYPTOCURRENCY 102 – MY PICKS FOR 2018

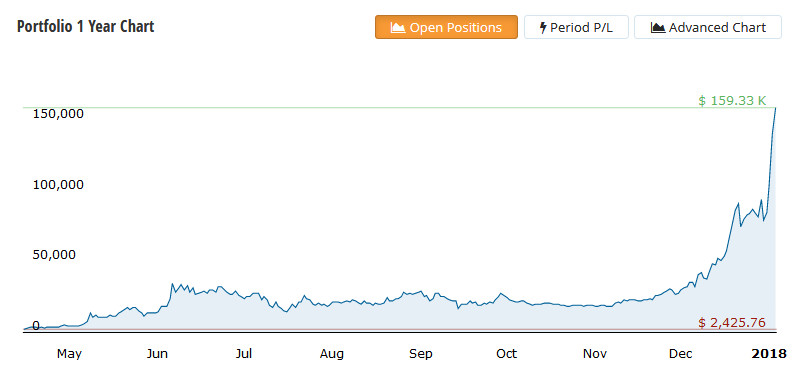

This is my January 2018 update to the Crypto 101 post I wrote in May 2017. Those recommendations did amazingly well, and this is my second crack at predicting the future. The original post is down below.

Way back in the depths of history eight months ago when I did my Cryptocurrency 101 post it was a very different crypto scene.

I was a bit nervous about doing a post on cryptos that would remain on the blockchain and make me look like a complete dickhead if I got it all wrong.

But thankfully, when I look back on it now, I did make some good picks. Although the post itself only paid out $3.35, these eight cryptos (in the following order) were what we invested in and by the end of the year they had gone up more than 30 fold.

Bitcoin (BTC), Steem (STEEM), Digital Cash (DASH), Monero (XMR), Augur (REP), Ripple (XRP), Ethereum (ETH), and Litecoin (LTC)

https://steemit.com/cryptocurrency/@sift666/cryptocurrency-101

For 2018 there are two big changes to my recommendations:

Firstly – move on from Bitcoin. It’s could be past it’s day and destined to become the Myspace of cryptos. It was the first coin we bought and the first one we ditched.

While we held on to it up to $17 000 in December 2017, I must admit I was starting to sweat and was relieved to dump it before it crashed. Now I think it’s more a religion than a cryptocurrency, but hell we did well on it!

Secondly – invest in a wider range of coins – now we have 26 rather than 8. While we are still mainly focused on the big names like Etherium and Litecoin, we also have holdings in a bunch of long odds gambles.

My personal favourites along with Steem are Monero, Cardano, Dash and Smartcash, but we still also have Ripple even though I hate the dodgy bastards, because it’s like a license to print money, and Bitcoin Cash too just in case it swaps with Bitcoin and becomes the n00b must have coin.

So now we have holdings in all of these coins:

Aragon (ANT)

Augur (REP)

Basic Attention Tokens (BAT)

Bitcoin Cash (BCH)

Bitcoin Diamond(BCD)

Bitcoin Gold (BTG)

Bitshares (BTS)

Cardano (ADA)

Digital Cash (DASH)

Dogecoin (DOG)

Ethereum (ETH)

Ethereum Classic (ETC)

Factom(FCT)

Hyperstake (HYP)

Iota (IOT)

Lisk (LSK)

Litecoin (LTC)

Monero (XMR)

NEM (XEM)

NEO (NEO)

Ripple (XRP)

Salt Lending (SALT)

Smart Cash (SMART)

Steem (STEEM)

Steem Dollars (SBD)

Z-Cash (ZEC)

Some will hopefully do well, and some may turn to shit, but not to worry, it’s all a big gamble and now we have a whole flock of horses in the race.

If I turn out to be wrong about Bitcoin a large crowd of angry people will gather to beat me with sticks. But here it is all recorded forever on the blockchain: “Bitcoin is a washed up has been” said @sift666

https://steemit.com/cryptocurrency/@sift666/cryptocurrency-102-my-picks-for-2018

Cryptocurrency 101

Is Cryptocurrency the future? – We are betting that it is, and have made very good returns.

(this section was originally written in May 2017 and all the recommendations rapidly did amazingly well – it hasn’t really been updated but I’d still invest in these cryptos except Bitcoin – they were good picks!)

PAGE INDEX

SOME USEFUL CRYPTOCURRENCY SITES

A FEW NEWB THOUGHTS ABOUT CRYPTOCURRENCIES

OUR PICKS FOR CRYPTOCURRENCIES TO WATCH IN 2017

DASH – OUR PICK FOR THE NEXT BIG THING

WILL THERE BE A BITCOIN CRACKDOWN?

RANDOM OTHER CRYPTOCURRENCY STUFF

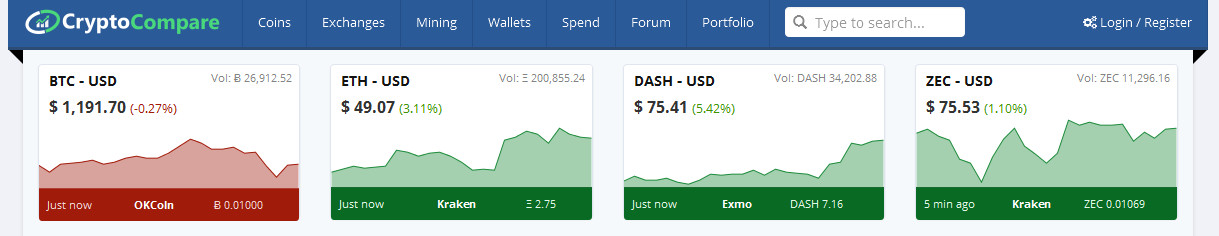

CRYPTO COMPARE

CRYPTO COMPARE

SOME USEFUL CRYPTOCURRENCY SITES

A great site for comparing and learning about crypto stuff that also has a brilliant portfolio feature – https://www.cryptocompare.com/

CRYPTO CURRENCY CHART

CRYPTO CURRENCY CHART

A handy site for watching crypto currency prices – www.cryptocurrencychart.com

BITTREX

BITTREX

This used to be a reliable cryto currency exchange, but it has gone downhill. It was better than the bigger Poloniex exchange which crashed all the time and was totally hopeless,but Bitcoin is unreliable now too

JAXX WALLET

JAXX WALLET

A wallet that works on older 32 bit windows PC’s (Exodus requires 64 bit) – https://jaxx.io/

EXODUS WALLET

EXODUS WALLET

This is very cool and this is the walllet we use (it requires 64 bit Windows)

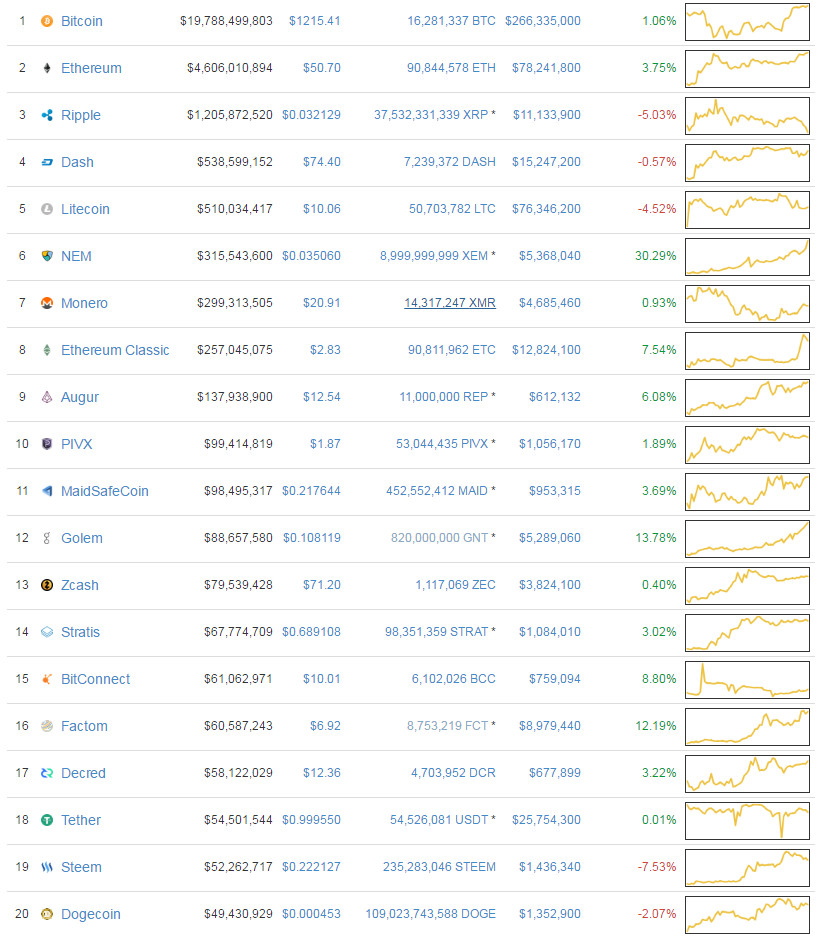

CryptoCurrency Market Capitalizations

CryptoCurrency Market Capitalizations

www.coinmarketcap.com

CoinGekko

CoinGekko

A FEW NEWB THOUGHTS ABOUT CRYPTOCURRENCIES

Cryptocurrencies only really started to slowly take off around 2010, and the first popular one was Bitcoin. In 2010 the price of a Bitcoin first hit US$1, and by the start of 2017 it was up to US$1200. So if you bought $1000 worth of Bitcoin in 2010 it would now be worth $1.2 million! Today Bitcoin is so totally dominant that people often use the word Bitcoin when they really mean crypto currencies in general.

In fact there are hundreds of different cryptocurrencies, most of which are utter rubbish that nobody will ever use, but there are at least 10 that look promising. We expect Bitcoin to remain dominant for years to come because it has a bit of a Monopoly at this point, but we think a few others will start catching up with it in popularity.

Another similar subject that cryptocurrencies strongly remind us of is Linux distros. There are also hundreds of different versions of Linux, but only about 10 are much good. For many years Ubuntu was totally dominant and always number one. (You can see the top 100 versions of Linux ranked on DISTROWATCH) But from 2010 Ubuntu never got any better, and in fact it seemed to get worse with each release. (I have a webpage about Linux HERE)

Meanwhile the other distros got a lot better. Linux Mint came to totally overtake Ubuntu and was better in every way. (I have a blog post about that HERE) But Mint remained in the number two spot behind Ubuntu for years. It’s number one now, but that took a long time.

Cryptocurrencies are also another parallel universe that have their own language. The different currencies are often referred to as “coins”. They are stored in “wallets” and traded in “exchanges”. It’s all very new, and at this point not many business are set up to accept them as payment.

The first thing we did when we began using Steemit and earning payments in “Steem” (a new crptocurrency) was to see if it was all for real. Could we convert our Steem into NZ$?

Yes we could. First we needed to convert the Steem into Bitcoin using an exchange (we use Bittrex), and then we needed to convert our Bitcoin into NZ$ using a local currency exchange (we use NZ Bitcoin Exchange). From there we could transfer it into our bank account.

Happy with the way it all worked out we transferred it back into Steem, using the reverse of that process, and didn’t do much further with crptocurrency trading after that.

But now as ex share traders, and Steemit fans, with our own online business (Nature Foods), we are increasingly thinking cryptocurrencies are going to be the next big thing, maybe not as big as internet porn, but certainly as big as smart phones or Fakebook.

The first thing we found as we started getting into crypto currencies is that the subject is really confusing, and difficult for a non-tech beginner to understand.

A cryptocurrency we are interested in is DASH (Digital Cash) which seems to offer several improvements over Bitcoin. It is now worth over US$70 a unit. We want to invest in this currency in the hope that it will become widely used and later go up to over US$1200 like Bitcoin.

So we started out by transferring our Bitcoin onto the exchange that we use (Bittrex) and then we bought some different cryptocurrencies. It’s very like share market trading. We put in a buy offers and buy the cryptocurrencies we want to invest in. The fees are really low, a lot less than share trading.

We use another site (Crypto Compare) to keep a record of our portfolio so we can watch as we become millionaires.

Why do we think cryptocurrencies are going to be the next big thing? First and foremost because of desperate government attempts to outlaw the use of cash.

In all countries there are two economies, the official one, and the underground or shadow economy. For example in New Zealand the marijuana industry is big (it’s NZ’s most valuable crop) but it’s entirely underground. And when a tradesman says “that will be $500, or $400 if you pay cash”, he is offering you a choice of the official or the shadow economy.

In some countries the shadow economy is bigger than the official economy (70 %+). It is very high in regions like Africa, but even in first world countries, it’s generally at least 20% of the economy (it tends to be vastly underestimated, because it’s almost impossible to measure). Any transaction that doesn’t pay tax is part of this sector, and that can include everything from buying some drugs to getting your car windows washed.

As with attempts to outlaw “illegal downloading” (remember Napster?) any attempt to stop something on the internet creates a massive increase in it. (One of my favourite things about the internet) And whether its cash or cryptocurrencies, there is a massive desire for an anonymous and untaxed payment system.

OUR PICKS FOR CRYPTOCURRENCIES TO WATCH IN 2017

![]() After using Steemit for eight months and being paid there in Steem, and also having used Bitcoin a few times, we started to wonder if any of the other currencies apart from Bitcoin have a solid future. They are frequently hyped, and their values go up and down like yoyos. But do they have long term prospects?

After using Steemit for eight months and being paid there in Steem, and also having used Bitcoin a few times, we started to wonder if any of the other currencies apart from Bitcoin have a solid future. They are frequently hyped, and their values go up and down like yoyos. But do they have long term prospects?

One theory is that Bitcoin was first, so that like Fakebook, it will remain dominant in it’s own area. This could turn out to be true, but we’re inclined to think cryptocurrencies are still very new, Bitcoin is already an old donkey, and there is plenty of room for new innovations.

Here are the cryptocurrencies we have investing in ourselves, and they have done very well. We don’t attempt to “trade” – we buy and hold, and generally they go up overall.

Bitcoin (BTC)

Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions and the issuing of bitcoins is carried out collectively by the network. Although other cryptocurrencies have come before, Bitcoin is the first decentralized cryptocurrency – Its reputation has spawned copies and evolution in the space.

With the largest variety of markets and the biggest value – having reached a peak of 18 billion USD – Bitcoin is dominant. As with any new invention, there can be flaws in the initial model, however a team of developers are aiming to fix any issues they come across. It is by far the most traded crypto currency and, in recent times, it has become the most price stable as well, you rarely see price movements of more than +-5% in a 24 hours interval.

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) is a hard forked version of the original Bitcoin. It is similar to bitcoin with regards to its protocol; Proof of Work SHA-256 hashing, 21,000,000 supply, same block times and reward system. However two main differences are the the blocksize limits, as of August 2017 Bitcoin has a 1MB blocksize limit whereas BCH proposes 8MB blocks. Also BCH will adjust the difficulty every 6 blocks as opposed to 2016 blocks as with Bitcoin.

Bitcoin Cash is a proposal from the viaBTC mining pool and the Bitmain mining group to carry out a UAHF (User Activated Hard Fork) on August 1st 12:20 pm UTC. They rejected the agreed consensus (aka BIP-91 or SegWit2x) and have decided to fork the original Bitcoin blockchain and create this new version called “Bitcoin Cash”. Bitcoin Cash can be claimed by BTC owners who have their private keys or store their Bitcoins on a service that will split BCH for the customer.

Steem (STEEM) Steemit is a blockchain-based social media platform where anyone can earn rewards by posting relevant content, curating quality content by upvoting and by holding Steem based currencies in a vest fund, which generates interest.

Steemit is a blockchain-based social media platform where anyone can earn rewards by posting relevant content, curating quality content by upvoting and by holding Steem based currencies in a vest fund, which generates interest.

There are three main currencies in Steemit: Steem, Steem Power (SP) and Steem Backed Dollars (SBD).

Steem is liquid and can be bought in an exchange and converted into steem dollars or steem power.

Steem Power is basically Steem that is locked in a vesting fund for 3 months. Users can use steem power to upvote content and get curating rewards.

When a user upvotes content his steem power gets depleted and then slowly regenerated. Steem Power holders receive interest from their holdings. The more Steem Power a voter has the more revenue he’ll generate for himself (in form of SP) and for the content creator (In SBD).

There is also an incentive to upvote content early, as the rewards are distributed according to time. The earliest votes gets the biggest share of the reward.

Steem Backed Dollars are there to protect content creators from volatility and can be traded for roughly 1 usd worth of steem, in order to cash out from Steem. Converting Steem backed dollars into STEEM takes 5 days. Users also receive interest from holding SBD.

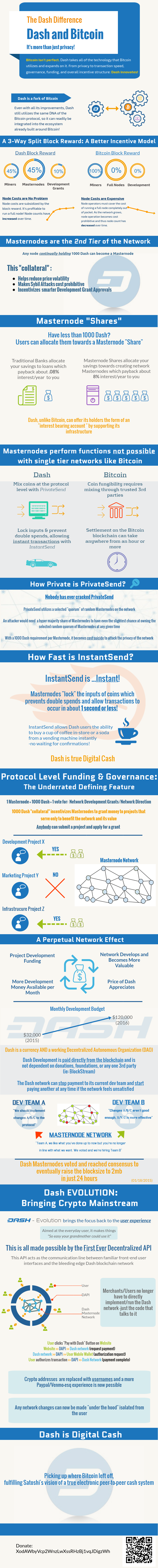

DigitalCash (DASH)

DigitalCash (DASH) uses a new chained hashing algorithm approach, with many new scientific hashing algorithms for the proof-of-work. DASH aims to be the first privacy-centric cryptographic currency with fully encrypted transactions and anonymous block transactions, this feature is called PrivateSend and can be found on the official Dashcore wallet.

PrivateSend mixes your DASH coins with other users who are also using this feature at the time, making your transactions untraceable.

Users can also earn DigitalCash rewards by hosting a master node to help maintain the Blockchain. One must have a balance of at least 1000 DASH in order to host a Dash master node, this collateral is required to avoid 51% attacks on the network.

Monero (XMR)

Monero (XMR) is a cryptonight algorithm based alternative crypto currency. The coin is based on Proof of Work and has a block reward that varies smoothly. The difficulty retargets every block with a sixty second block target.

Monero uses a Ring Signature system to protect your privacy, allowing users to make untraceable transactions.

Augur (REP)

Prediction markets are widely considered the best forecasting tool. Augur is an open, global platform where anyone anywhere can create, monitor or trade in prediction markets about any topic. Think of it as an “Early Warning System” with the most accurate event forecasts, a potential “Google Search”, “Bloomberg Terminal” or “Reuters Terminal” for crowdsourced event forecasts.

Prediction markets are widely considered the best forecasting tool. Augur is an open, global platform where anyone anywhere can create, monitor or trade in prediction markets about any topic. Think of it as an “Early Warning System” with the most accurate event forecasts, a potential “Google Search”, “Bloomberg Terminal” or “Reuters Terminal” for crowdsourced event forecasts.

The system plans to use the “Wisdom of Crowds” (“collective intelligence”) via market incentives, “Long Tail” dynamics and blockchain technology to securely generate a more accurate, robust and unfiltered array of dynamic event forecasts than any alternative can match.

Augur is decentralized, self-regulating, pseudonymous and autonomous. It offers the promise of markets without exposure to counterparty risk, principal-agent problems or central points of control, failure or censorship. No person is ever in direct control of someone else’s funds or in a position to single-handedly threaten the system’s integrity.

The software is comprised of smart contracts perpetually deployed on a blockchain network, which enables applications deployed to be immune to local outages while benefiting from the entire community’s security. All interactions with markets are communicated as database transactions between unique accounts powered by immutable software instructions.

Ripple (XRP)

Ripple positions itself as a complement to, rather than a competitor with, Bitcoin – the site has a page dedicated to Ripple for bitcoiners. Ripple is a distributed network which means transactions occur immediately across the network – and as it is peer to peer – the network is resilient to systemic risk. Ripples aren’t mined – unlike bitcoin and its peers – but each transaction destroys an XRP which adds a deflationary measure into the system. There are 100 billion XRP at present.

Ripple positions itself as a complement to, rather than a competitor with, Bitcoin – the site has a page dedicated to Ripple for bitcoiners. Ripple is a distributed network which means transactions occur immediately across the network – and as it is peer to peer – the network is resilient to systemic risk. Ripples aren’t mined – unlike bitcoin and its peers – but each transaction destroys an XRP which adds a deflationary measure into the system. There are 100 billion XRP at present.

(Update – although we have some reservations about Ripple, and it’s real aims in the long term, to tell the truth investing in Ripple was like winning the lottery – 800%+ gains in under one month!)

Ethereum (ETH)

Ethereum is a unique cryptocurrency that presents a distributed computing platform that features the “smart contract” functionality. Many crypto-enthusiasts think that ethereum is undervalued

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third party interference. In the Ethereum protocol and blockchain there is a price for each operation. The general idea is, in order to have things transferred or executed by the network, you have to consume or burn Gas. The cryptocurrency is called Ether and is used to pay for computation time and for transaction fees.

If you want to earn block rewards from the network, you can join the network as a miner. Follow the link for a guide on how to mine Ethereum on a Windows Pc. The much easier but a bit more expensive way is to buy an Ethereum mining contract.

Ethereum is how the Internet was supposed to work. As long as you have enough funds to pay for your code to be run by the network, your contacts will always be up and running.

It was crowdfunded during August 2014 by fans all around the world. It is developed and maintained by ETHDEV with contributions from great minds across the globe. There is also an Ethereum foundation and there are multiple startups working with the Ethereum blockchain.

Ethereum is currently on the “Homestead” stage and all its related software is still considered Beta until the release of the next stage “Metropolis”.

Litecoin (LTC)

Litecoin LTC – provides faster transaction confirmations (2.5 minutes on average) and uses a memory-hard, scrypt-based mining proof-of-work algorithm to target the regular computers and GPUs most people already have – which are its main differentials to Bitcoin. The Litecoin network is scheduled to produce 84 million currency units with a halving in reward every four years just like bitcoin. The coin was created by a Google employee, Charles Lee.

NEM (XEM)

NEM is a peer-to-peer crypto platform. It is written in Java and JavaScript with 100% original source code. NEM has a stated goal of a wide distribution model and has introduced new features in blockchain technology in its proof-of-importance (POI) algorithm. NEM also features an integrated P2P secure and encrypted messaging system, multisignature accounts and an Eigentrust++ reputation system.

NEM has gone through extensive open alpha testing starting June 25, 2014, followed by lengthy and comprehensive beta testing starting on October 20, 2014. NEM finally launched on May 31, 2015.

https://www.cryptocompare.com/coins/#/btc

THE TOP TWENTY CRYPTOCURRENCIES BY MARKET CAPITALISATION

DASH – OUR PICK FOR THE NEXT BIG THING

DASH is our pick to supersede Bitcoin – www.dash.org

Dash is a cryptocurrency much like Bitcoin with some new features designed to make it easier to use and it is seeing some strong growth.

Instead of relying on angel developers to materialize and build features for users to use like bitcoin does, Dash has a reserve of funding set aside to pay for its own marketing and to develop user-friendly features.

Ten percent (10%) of all funds generated goes to the treasury to fund these projects and so the amount available varies depending on the market cap but is still a good deal of funding. As of today, there would be about $600,000 dollars available to fund projects this month. (March 2017)

They are working to develop user interfaces that your mom could feel comfortable using which makes it more appealing to the masses and easier to use, things that Bitcoin (and Steemit) are lacking. These features will be rolled out sometime in late 2017 in a product called Dash Evolution.

They have an approachable spokesperson in Amanda B. Johnson who connects a highly technical topic to the general public using simple to understand analogies in an easy to digest manner. She’s good at explaining everything and keeping people up to date with what’s going on with Dash in general.

Communicating with the public is very important and something that Bitcoin, Steemit, and others could learn a lot from by adopting some of these ideas being developed at Dash. Tech geniuses and programming geeks sometimes forget to reach the public in an approachable manner and at regular intervals and Dash is a shining example of good PR.

Things are looking good at Dash and they are definitely doing something right. There’s always the chance this all a pump and dump, but the core pitch and systems they have in place seem to say this is the real deal. Only time will tell.

https://www.youtube.com/channel/UCAzD2v9Yx4a4iS2_-unODkA

https://www.youtube.com/channel/UCAzD2v9Yx4a4iS2_-unODkA

Dash School videos by Amanda B. Johnson

Bitcoin vs Dash digital cash – Which will achieve mass adoption first?

Will there be a Bitcoin Crackdown?

By James Corbett – corbettreport.com

We all know the old dictum: “If you can’t beat ’em, join ’em!” Well, governments have their own version: “If you can’t beat ’em, use your jackbooted thugs to go out and steal their idea and outlaw all competition.”

Case in point: bitcoin.

As I pointed out in my Tech Trends for 2017 editorial, bitcoin regulation is going to be one of the dominant themes of the year. Indeed, that prediction has (unfortunately) already come true, with the EU Council proposing the registration of all bitcoin users under the guise of “anti-terrorism” legislation and the IRS’ legal pursuit of information on all Coinbase users continuing to play out in the courts.

Check the newswire on any given day and you’ll see any number of government regulators looking to get their regulatory mitts on the cryptocurrency:

- Japan’s new regulation regime for bitcoin and “other virtual currency” takes effect this April.

- The Philippines’ Central Bank just issued a circular detailing a raft of new regulatory requirements for virtual currency exchanges.

- The Australian Digital Currency & Commerce Association has pre-empted the Aussie government by coming up with their own self-regulatory code of conduct.

But perhaps nowhere is this clampdown more obvious than in China, where the population’s hunger for circumventing capital control laws is matched only by the government’s hunger for clamping down on capital outflows. The booming Chinese bitcoin market has been widely recognized as the driving force behind the currency’s meteoric rise in the last six months to once again pass the $1000 mark, and it has not done so without drawing renewed scrutiny from the so-called authorities.

After months of whispered speculation, rumors, gossip and leaks indicating a coming Chinese crackdown on bitcoin, some dramatic steps have been taken in recent weeks. First came news that the People’s Bank of China had met with nine smaller local exchanges “to discuss risks and problems in the bitcoin market” (i.e., threaten them if they don’t strictly enforce all rules and regulation). Then Okcoin and Huobi, two of the largest Chinese exchanges, surprised the market by announcing that they would be suspending withdrawals for one month so they could “upgrade” their systems to comply with “anti-money laundering efforts, foreign exchange management and other financial laws and regulations.” Now BTCC (which, along with Okcoin and Huobi, comprises the “Big Three” of Chinese exchanges) has followed suit.

But this renewed pursuit of bitcoin by government regulators is not happening in a vacuum. As I reported earlier this week, the Chinese government has also just “completed the trial in transactions and settlements of bank acceptance bills using a digital currency it developed, supported by blockchain technology.” In other words, China is prepping its own digital currency based on blockchain technology to help transition China into a cashless society.

For those who don’t know, the blockchain is the key technological innovation upon which the bitcoin platform is based. It is, essentially, a distributed database where entries are created as “blocks” and ordered in a “chain” by a time stamp with a link to the previous block.

The innovation is that the database is autonomous, decentralized, permissionless and secure by design. As such, it makes a decentralized cryptocurrency like bitcoin (and many other virtual currencies) possible. There need be no central authority that verifies and certifies transactions, as the verification and time ordering of transactions are accomplished through proof of work (solving Hashcash puzzles in the case of bitcoin). Mining nodes validate transactions by solving these cryptographic puzzles and are rewarded with newly “mined” coin.

Of course, virtual currencies aren’t the only thing that blockchains can be used for. Since a blockchain can be used to store records forever in an unalterable manner they are particularly useful for registration and record management, smart contracts and other applications that radically disintermediate society by cutting out the need for bankers, lawyers, registrars and other middle men who previously acted as witnesses and central authorities for recording and managing interactions between people.

You can see why governments see this technology as a double-edged sword: Wielded for their purposes, it presents a perfect platform for their Big Brother-esque ambition to oversee, manage, track, store and database all interactions between everyone, everywhere, instantaneously and at next-to-no cost. But wielded for free humanity’s purposes, it makes almost every conceivable function of the government as obsolete and nonsensical as horseshoe makers and chimney sweeps are to modern society.

As a result, at the very same time we see this incredible, snowballing and omnipresent push to regulate bitcoin and other virtual currencies, we are also witnessing an incredible, snowballing and omnipresent interest in the idea of “private blockchains,” distributed databases developed and used by governments, businesses, universities and bankers to cut their own costs and speed up their own transactions.

- The Bank of Canada’s deputy governor has recently revealed details of the bank’s “Project Jasper,” an experiment to build “a simulated wholesale payment system” using blockchain technology.

- The US government has just created a Congressional Blockchain Caucus to “help policymakers create sound regulatory policies surrounding these technologies.”

- The State Bank of India is partnering with tech companies and local banks on a “Bankchain” initiative focusing on blockchain applications.

- MIT is working on a Digital Currencies Initiative that is exploring various uses for blockchain technologies for government, central banks and business.

If the central bankers of the world have their way, private, centralized blockchains will be used to facilitate international trade and settlement by and for the bankers, and government regulations will stop any of those pesky citizens from transacting among themselves.

But don’t worry, there is a silver lining to all of this: Bitcoin is ultimately uncensorable and unstoppable. Don’t take my word for it, take the former Governor of the Bank of China, L H Li, who just told CCTV: “If you want to kill bitcoin, it will be an impossible task.”

And he would know. After all the crackdowns on bitcoin exchanges in China, it seems the Chinese are just using alternative platforms like Localbitcoin to arrange for peer-to-peer or even face-to-face transactions instead of going through the exchanges. As it turns out, if you put arbitrary, government-imposed obstacles in people’s way, they’ll simply find other ways to interact that bypass those obstacles. Who would’ve thunk it?

The point is that there is no “off switch” for the bitcoin platform, no central node that can be disrupted, no server that can be seized, no premises raided, no person arrested that will take down bitcoin. That’s the whole point of a decentralized, peer-to-peer distributed ledger. It means that unless and until governments can stop people from passing strings of letters and numbers to each other (even on physical pieces of paper) then bitcoin will never be brought down completely. Yes, governments can and will (and are) regulating the exchanges that most people use to change their fiat currency into bitcoin (and vice versa), but they can’t stop people from transacting bitcoin.

In the end, this creates a strange and uneasy relationship between governments, banks and the general public.

Bitcoin exchanges will continue under increasingly burdensome regulatory restrictions, and setting up accounts and transacting with others via exchanges will eventually be more time-consuming and annoying than setting up a bank account.

And governments, banks and other large-scale institutions will increasingly be developing their own private cryptocurrencies for settling transactions amongst each other or private blockchains for performing record management and registration services. If you can’t beat ’em, steal their idea and outlaw all competition!

Luckily for free humanity, it will be impossible to outlaw direct bitcoin transactions altogether. Bitcoin will continue to be traded directly, peer-to-peer, via LocalBitcoins and OpenBazaar and other platforms, or just plain face-to-face interaction.

By James Corbett – corbettreport.com

RANDOM OTHER CRYPTOCURRENCY STUFF

Lamborghini now accept Bitcoin

The next level of online shopping

“Buy new Lamborghini’s straight from the factory. The supercars are shipped directly to you! Bitcoin is accepted as a form of payment”

https://steemit.com/cars/@hilarski/experience-the-lamborghini-huracan-lp610-4-2017-steemit

https://coinmarketcap.com/

https://coinmarketcap.com/